Australian fintech Capital & Centric Funding opens its doors to litigation funding

Capital & Centric Funding, an innovative Australian fintech company has announced that it will be prioritising litigation funding.

Steve Smith bolsters investment portfolio with Bamboo brand ambassadorship and equity stake in company

Cricketer Steve Smith has joined forces with Bamboo, becoming its new brand ambassador and equity holder, securing a minority stake in the company.

Finance expert predicts older Australians will downsize sooner and a younger demographic of ‘downsizers’ will emerge in 2023

Consecutive interest rate rises, cost of living and the highest levels of inflation is putting pressure on households, but it is also providing an opportunity for older homeowners to re-assess their financial position.

Post-Covid surge in business start-ups fuels mobile payments: CommBank

Research by the Commonwealth Bank of Australia shows one in three Australians have started a small business since the start of the pandemic.

Alex.Bank sees 56% surge in Personal Loans, with 90% of new originations coming from brokers

Alex.Bank, Australia’s newest Bank, has seen an increase in personal loan origination, by over 50% since the start of 2023.

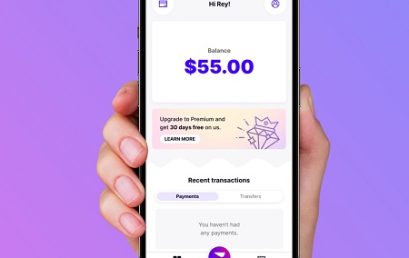

Money App for workers Nine25 announces cashback and social rewards

Nine25 is further enabling consumers to switch away from outdated bank accounts by launching a cash back to customers in Australia.

Shaype successfully completes fifth consecutive SOC 2 audit to assure customer security and privacy

Shaype®, the Australian end-to-end embedded finance platform, has achieved SOC 2 Type I certification for the fifth consecutive time.

Ovolo & RoomStay disrupt the hotel industry by offering PlanPay, the first digital lay-by payment option

Ovolo is the first hotel collection to offer PlanPay, making booking a hotel even more effortless and ethical.