Half of Superhero investors plan to invest their tax return this year

Superhero, a leading share trading and superannuation platform has today released new insights into the investment habits and preferences of Australians.

Over 1,300 investors were surveyed with Superhero finding 50% are planning on investing this year’s tax return (if they receive one) in the stock market. This figure increases to 59% of female Superhero investors, significantly higher than the 48 % of male Superhero investors.

In addition, nearly half (49%) of Superhero investors said they are planning on using the new financial year to sort out their financial goals for the year ahead. Younger investors clearly view the end of financial year as an opportunity to start afresh with nearly two-thirds (62%) of Superhero investors between 18 and 24 agreeing with this statement.

CEO and Co-Founder of Superhero, John Winters said, “It’s apparent that our investors have a ‘new financial year, new me’ attitude. What’s great to see is a sense of optimism about the market, and a renewed focus to use the current state of the market as an opportunity to grow wealth.”

“To see our younger investors so resolutely look to July as an opportunity to set themselves up for long-term financial success is encouraging. These mid-year resolutions are able to be adjusted and built on by the time 2023 gets here too – and it’s refreshing to see a generational attitude where personal finances and financial wellness are prioritised from a young age.”

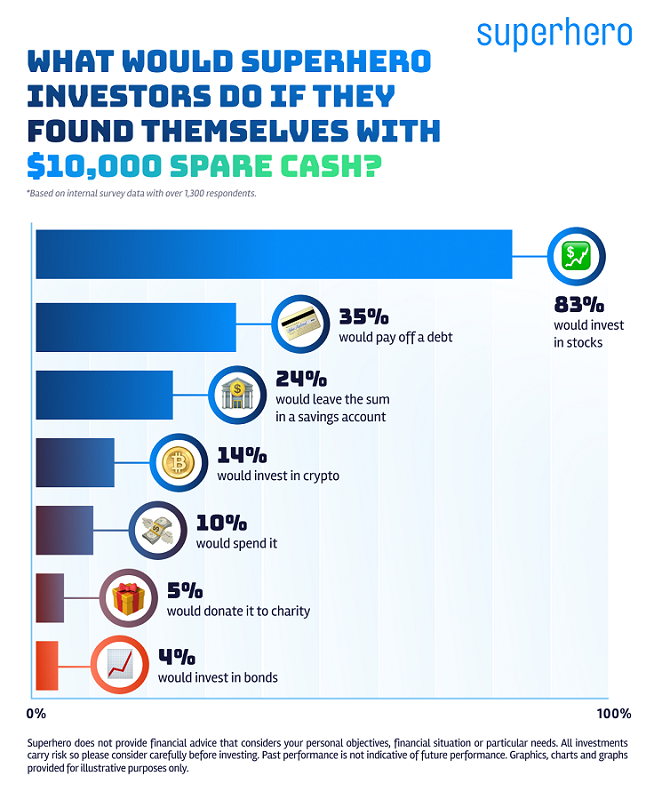

When Superhero investors were asked what they would do if they found themselves with $10,000 ‘spare cash,’ a whopping 83% said that they would invest in stocks. Other key insights are below (respondents could select more than one option):

- 35% said they would pay off a debt.

- 24% said they would leave the sum in a savings account.

- 14% said they would invest in crypto.

- 10% said they would spend it.

- 5% said they would donate it to charity.

- 4% said they would invest in bonds.

The research also delved into the investment practices of Superhero investors – with nearly half of Superhero investors (45%) saying they put aside a certain amount of money each week or month to invest. A further 32% of Superhero investors said they invest when they have spare cash and 21% said they invest when they see an opportunity in the market.

Winters continued, “We know that investing has grown significantly in popularity over the last few years. With nearly half our Superhero investors being regular investors, it’s positive to see that the current dip in the market has not deterred investors from their strategies when it comes to growing their wealth.”

“Our investors don’t want their hard-earned money just sitting in a low interest bank account – they want their money to grow and create real value. They have clear goals and are really starting to engage with their money – learning how to grow it in the most sustainable way possible.”