Nine25 App becomes Australia’s first money app for workers

Australian fintech Nine25, announced the next phase of its product feature release roadmap: As Australia’s first money app for workers.

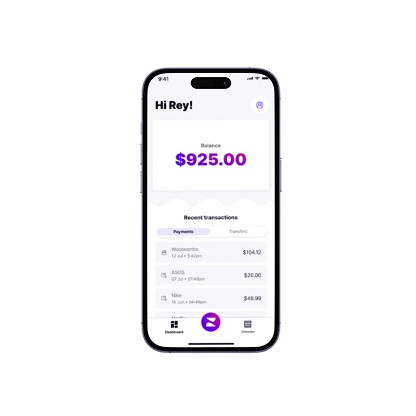

The Nine25 App will be a first-of-its kind mobile phone app that enables Australian employees to better manage their money through a suite of tools that includes a virtual account (BSB & Account number), integrated Mastercard, the ability to receive the money they earn every hour, automated bill allocation, bill payments, and investing.

“What we’re saying is that you’re no longer going to need a bank account to do your banking or manage your money,” explained Nine25 Founder, Leigh Dunsford, “With a Nine25 App account, you get your own virtual account that you can set up in 30 seconds. From there you can receive your salary or wages every hour, allocate it towards your bills, goals, and investments. And once you take care of your money responsibilities, you can tap & pay wherever Mastercard is accepted, world-wide.”

Nine25 set out to solve the biggest challenge facing every Australian employee, whether they work in retail, hospitality, healthcare or sit on video calls all morning: Not having the time to manage their money effectively.

Until now, the only way for Australian workers to receive their salary and wages was their bank account. After that, they were at the mercy of dozens of disparate budgeting, bill management, lending, financial wellness, trading, and investing apps that all claimed to work towards a better financial future despite not working in a cohesive manner.

“We’re not just giving Australian employees and workers a new way to transact like a bank, we’re setting them up with cohesive set of tools that would automate every aspect of managing their money within a single app,” said Dunsford, “Once you deposit your salary and wages, you’re able to pay your bills, tap & pay with your card and even start building long-term wealth through investing.”

Nine25 uses the services of Zai, a global financial technology company that partners with Standard Chartered Bank for its digital wallet and payments technology, EML Payments for its Mastercard program and Cache for its soon-to-be-launched portfolio investing programme. Nine25 Premium, which allows workers to receive the money they earn in the app every hour, is powered by payroll system integrations that verifies a user’s salary and income, then grants them access to stream their money as they earn it.