This Broker let AI do the talking – The results? Game-changing

In a significant development for the mortgage broking sector, Melbourne-based broker Sadish Visvalingam has successfully refinanced more than $20 million in loans by utilising an Artificial Intelligence-powered virtual assistant built by fintech startup Effi Technologies. This achievement demonstrates AI’s potential in mortgage operations and highlights how technological innovation can enhance community outcomes.

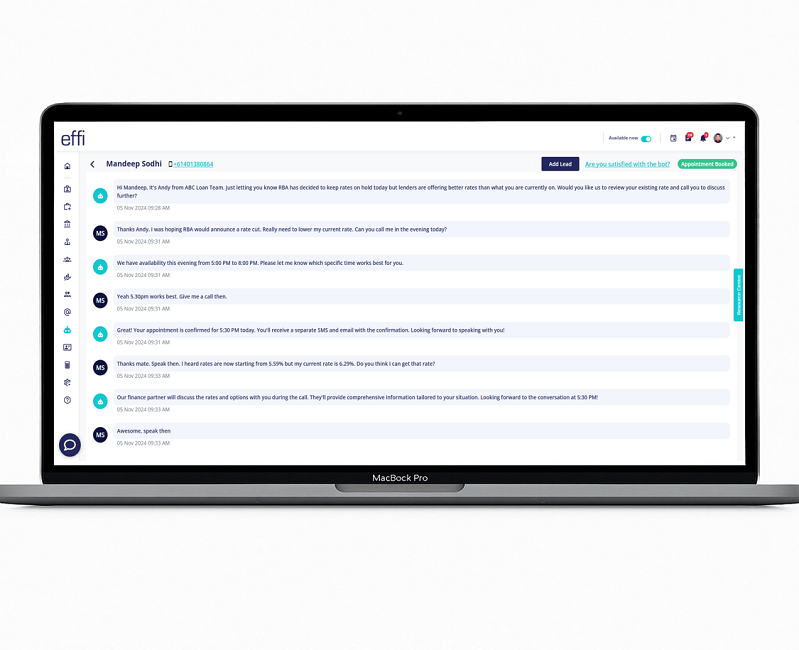

The AI assistant, embedded within Effi’s broker-centric CRM, autonomously reached out to both existing clients and leads acquired from local community events via SMS. It conducted intelligent, conversational interactions and scheduled appointments directly into Sadish’s calendar — eliminating the need for manual intervention.

“This is a transformative advancement,” said Sadish. “The AI tool enabled us to engage more households with greater efficiency, helping them secure improved interest rates and ultimately reduce their financial burden. It’s technology with a tangible human benefit.”

Effi has also introduced a Voice Agent capable of handling frequently asked questions, managing post-settlement client follow-ups, and executing routine outreach tasks. Though still in its pilot phase, the voice bot is showing early signs of promise. “We believe this tool will continue to evolve rapidly,” Sadish added. “What it can do now is impressive — and it’s only going to get better. It has the potential to redefine how brokers manage client relationships.”

To share the benefits of AI integration with peers, Sadish co-hosted a sold-out AI Implementation for Brokers workshop in Melbourne. The training session provided practical education on applying AI tools to streamline workflow, improve compliance, and deliver stronger client engagement across the board.

“AI is not here to replace brokers,” said Sadish. “It’s here to enhance what we do — giving us more time to connect with our clients, understand their needs, and provide strategic, long-term guidance.”

To further support industry adoption, Sadish also launched BrokerVsAI, a focused initiative to simplify AI onboarding for brokers seeking to modernize their operations.

With mortgage brokers now accounting for 76% of the Australian home loan market, this evolution represents more than a trend — it’s a shift toward smarter, more client-focused broking practices. Visionaries like Sadish Visvalingam are proving that the future of mortgage broking is not just digital — it’s intelligent, empathetic, and community-driven.